Utah's Complex

Estate Planning Experts

What Makes an Estate Complex?

- Are you in a second marriage?

- Do you have children with addictions or who are financially struggling?

- Are your children angry or hostile towards you or their siblings?

- Do you have controlling or demanding personalities in your family?

- Any difficulties with the spouses of your children?

- Do you have a child with special needs?

- Do you own multiple properties, high-value corporations or business interests, or unique assets?

We Solve the Complex:

Meet with us to find out why:

- Separate trusts for couples are much more effective than joint trusts;

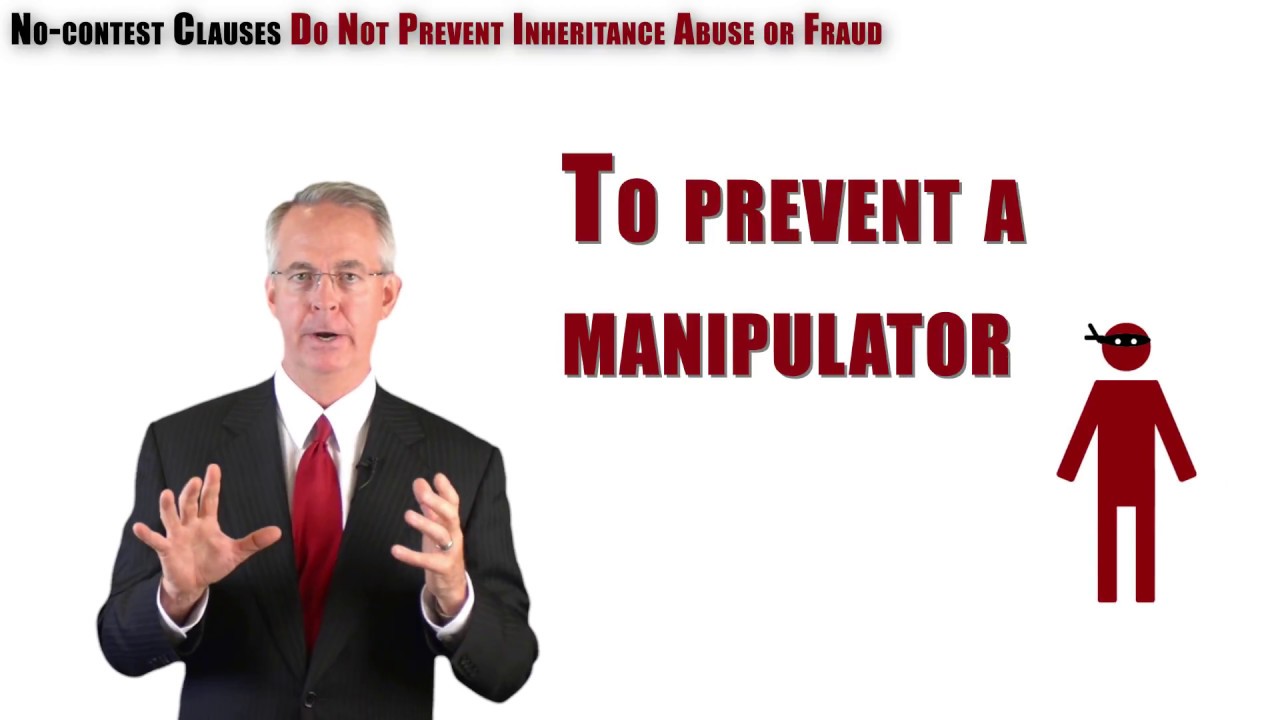

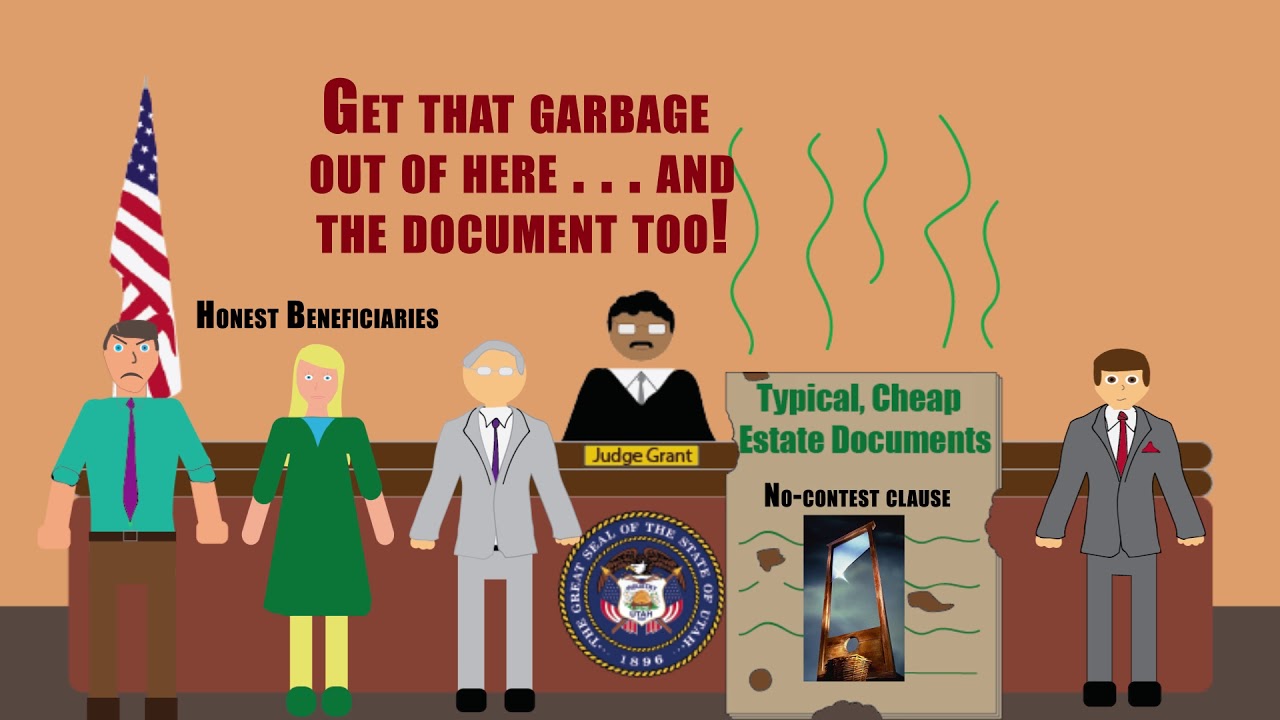

- “No-Contest Clauses” fail under Utah law and do not prevent contests;

- Arbitration Agreements are vastly superior to No-Contest Clauses;

- Our 31 years in Utah Courts guarantees your planning will work, no matter how complex.

EXPERIENCED

31 years Protecting Clients From Inheritance Litigation

DEVOTED

Authors of Four Utah Statutes Protecting Inheritance Assets

FOCUSED

Authors of Utah's Only Inheritance Protection Arbitration Agreement

OUR EXPERIENCES

Why Clients Choose Us

For 31 years we have experienced the most confrontational inheritance disputes imaginable — disputes that have destroyed scores of estate plans. Our experience knowing how plans fail means we know first hand how to ensure your objectives and intentions will succeed. For Decades we have also engaged in high-end estate planning, saving our clients millions of dollars in estate taxes.

0

+

Estate Plans Protecting Inheritance Intentions

0

+

Inheritance Conflict Cases Litigated

0

%

Inheritance Conflict Cases Won

$

0

M

What We Have Saved Clients in Estate Taxes

OUR SERVICES

Legal Practice Areas

Estate Planning

- Trusts; Wills; Powers of Attorney;

- Utah Asset Protection Trusts and Irrevocable Trusts;

- Second-Marriage and Hostile Beneficiary Inheritance Planning;

- Charitable Organizations and Foundations;

- Complete Funding Work

Conflict Prevention

- 31 Years Specialized Experience Fighting

High-Intensity Inheritance Conflicts in Court;

- 31 Years Ensuring Our Clients' Inheritance Plans Work--In Every Conceivable Scenario;

- 31 Years Protecting Our Clients' Estate Plans From Hostile, Manipulative, and Scheming Individuals;

- We Are the State's Premier Attorneys Engaged in Protecting Our Clients' Inheritance Planning From Manipulation and Theft

Special Needs Planning

- Supplemental Needs Trusts;

- Detailed Powers of Attorney;

- Guardian and Conservatorship Petitions

Trust Administration

- Professional Trustees With Tens of Millions of Dollars Under Trust Administration

Business Planning

- Buy/Sell Agreements;

- LLCs and Detailed Operating Agreements for Estate Planning, Tax Savings, and Protection and Control

Estate and Trust Taxes

- Estate Tax Attorneys Eliminating or Minimizing the Death Tax, saving clients over $24.3 million in taxes;

- Preparation of Forms 706, 709, 1041, and 1065;

- One of the states few experts with extensive experience in preparing complex Form 706.

31

years experience

0

+

Satisfied Clients

0

+

Published Articles

OUR EDUCATIONAL VIDEO LIBRARY

WARNING!

The following phrase in your will does not work: “If my beneficiaries contest my will, they are disinherited and get $1.00 only.” Under Utah Law these cheap “no-contest clauses” do not work — they do not prevent contests and do not disinherit contestants (Utah Code § 75-3-905). See our videos titled “No Contest Clauses.” After 31 years in court dealing with complex personalities and their tactics, we know how to effectively manage these personalities, without resorting to cheap provisions that are inherently flawed.